Finance vs. Accounting – A Breakdown of Each Degree & Career Paths

One of the most common questions around business today is whether you should pursue a career or degree in Accounting or Finance. It’s one of the most debated topics or questions for people looking to pursue either one of them. There is a lot of overlap between the two, and often work hand in hand.

Finance and Accounting are two of the important fundamentals of business. Each one has their own business, majors, and industries to pursue. Every company or operation is going to be dealing with both Accounting and Finance in some capacity. Accounting decisions deal with Finance, and Finance decisions involve Accounting.

The common questions up for debate are:

- Which degree is more valuable?

- What can you do with each degree?

- Which industry is better to build a career in?

- Which industry is the most financially rewarding?

- Which industry is better to work in?

The Definition of Accounting and Finance

Accounting is the system within a company that helps document and organize all of the operations, transactions, investments within a company. Primarily deals with organizing accounts, balancing accounts, and understanding the tax implications behind transactions.

Finance is the way in which a company manages its money. It deals with where it decides to invest, the financial strategy it decides to take, and how it plans to grow its capital. The finance department within companies, or financial companies are often the ones deciding whether to hold their capital, invest it, where to invest it, and what’s the best way to increase profits or value.

Breaking Down Each Degree

This depends on what you’re looking for, and what you’re interested in. Both fields have great opportunities available, and a wide array of niches to pursue. A lot of it depends on what you enjoy doing, and what you could see yourself doing for the foreseeable future. Both degrees will have some classes from each, but the majority you take will be in one or the other.

Finance Degree

Getting a degree in finance is going to teach you more about the investing side and the way companies manage their assets. The degree will teach you and show you the different ways companies look to invest their capital. Companies will shift or change their investment strategies based upon the current market, and their outlook on it. This might mean learning why and how companies shift their exposure to one industry like real estate, instead of technology at a given point during the market cycle. This also means learning how interest rates work, and the effect certain movements in the yield curve will have on the market. The position of the yield curve determines a lot within finance, and the future of finance. You’ll learn how to interpret the yield curve, and the way companies’ best position themselves to take advantage of the movements in the yield curve.

Another thing you learn in a finance degree is the different ways to invest into the market. You have different options, different stocks, and different debt formats. You’ll learn how companies use options to increase the amount of leverage or exposure with less money, but with more risk. You’ll see how and why companies issue the different forms of equity, in regard to preferred, and subordinate structures. You’ll see how and why companies issue debt to raise capital for other projects or to continue the company’s operations.

Part of a finance degree is also learning how companies structure their portfolios. What it means to diversify, why companies do it, and the different ways to do it. An incredibly important part of finance and investing is properly understanding the risk of an investment, and the levels of risk with investments. Learning how to limit your risk through diversification is an important part of a lot of company’s investment strategies.

An important part of finance is the different metrics and terminology used. With a finance degree, you’ll get familiar on what IRR (Internal Rate of Return), NPV (Net Present Value), PV (Present Value), and FV (Future Value) are. You’ll learn how to calculate each of these, and when each are supposed to be used.

Accounting Degree

A degree in accounting is going to teach you more about how to manage a company’s books and understanding the accounting aspect behind transactions. A lot of what you’ll learn is how to organize a company’s financial statements (balance sheets, income statements, and statement of cashflows. Every company or business is going to have its books, and accounting is the art of compiling them. The premise behind all of accounting is assets equals liabilities plus owner’s equity.

Accounting is the aspect of business that involves the way companies structure their finances, expenses, transactions, and taxes. An accounting degree will teach how every transaction should be recorded in each financial statement, the way it flows through, and the different classifications of accounts. You’ll get familiar with the differences between financial and managerial accounting.

You’ll learn when to use a credit versus a debit. What accounts are credit accounts, versus debit accounts. You’ll be able to organize a company’s books in an accrual basis or a cash basis (meaning when the money is earned versus when the money is received). You’ll understand the tax implications behind transactions, and what the most effective and efficient way to structure the transaction.

There are a multitude of different accounts that are considered an asset account, versus a liability account, and an equity account. Every transaction comes with a different set of standards and requirements, depending on the accounts involved. Classifying each transaction can either be a liability account, an asset account, or an equity account. You’ll learn when to use which, and the procedures that come with both.

What Can You Do with a Finance Degree?

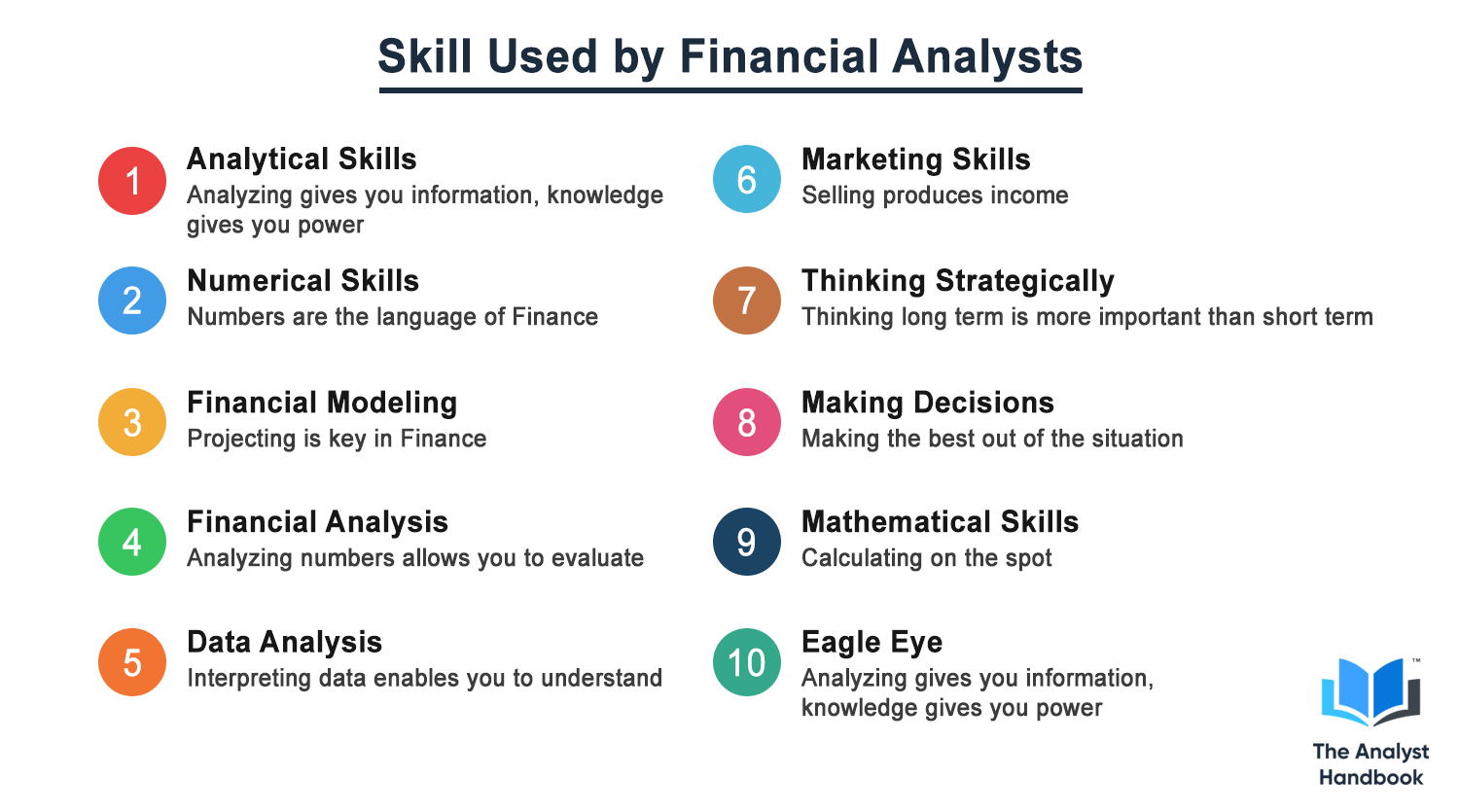

A degree in finance will open a lot of doors for you. Any position that deals with analyzing numbers, company’s finances, operations, or investing is something that’s on the table. Companies look for candidates with finance degrees who are going to be working with money, or in a role that handles finances.

This might mean you could find yourself doing

- Financial Analysis

- Financial Projections

- Evaluating New Opportunities

- Finding Pockets of Growth

- Investing Capital

- Researching Equities

- Assembling necessary documents

- Doing due diligence

When you start a new position or new industry, you’re going to have to work your way up. This means helping other people who are above, and often times doing the work that no one else really wants to do. That’s the nature of the finance world, and as you work your way up, the tasks become more exciting, and the pay gets better.

The culture within the finance world is very tough and has a high importance on paying your dues. Odds are companies are going to make you work hard for that promotion or bonus they are going to giving you. And the tasks you do, will gradually get better and more interesting over time as you rise up the ranks, and gain more valuable experience.

Each company has a different company culture of its own, but often times it’s a high-pressured environment, with tight deadlines, and large bonuses to go with it. The industry is built around money, and people are trying to make the most they can, meaning sometimes things can get rough.

If you’re just beginning in the industry, you’ll be tasked with helping your bosses compile and create the documents they need to move things up the chain. You might be doing the research they need, in order to make an investment decision or an important decision.

What can you do with an Accounting degree?

Getting an accounting degree opens lots of doors. The degree carries the most weight if you’re going into the accounting field but translates well into either the finance or business. The skills you’ll learn from an accounting degree apply to almost every business there is and will teach you a very translatable skillset.

The path most open to you is going to be accounting. This means going to work at one of the bigger accounting companies in an entry level position, where you’re able to get exposure to the area of accounting you’re interested in or to pick up some experience to decide where you want to go next.

The big accounting companies are constantly hiring entry level people for roles in their audit, tax, and advisory departments. Each of these departments plays a different role and has a different purpose within accounting. Most of the people in these roles have accounting degrees and are looking to either gain experience in accounting or pursue a career in it.

A career in accounting has a few different paths available to you at the more senior level, on the top of the hierarchy. Most of the people who build a career in accounting work their way up to Partner at a big accounting firm or find themselves as a company’s Chief Financial Officer.

At the top of every company, the CFO is the one who analyzes and understands the accounting implications behind every transaction or project. There’s always an element to business of accounting, whether its tax, audit, or trying to structure it in the best possible way. And the people who help make these decisions and provide input are usually the CFO of the company.

On the other side of the table, if you decide to try and become a partner at one of the big accounting firms, you’ll be trying to bring in business for the company and handle the relationships of your accounts. You’ll be the person responsible for handling and ensuring everything is done correctly and overseeing the work of the people below you.

Other positions you can find yourself pursuing from an accounting degree is a bookkeeper, controller, and Analyst. A degree in accounting will teach you one of the essential elements of finance, or business. You’ll. Companies will always be looking for and utilizing people with an accounting background.

What can you do with a Finance degree?

A degree in finance will give you a lot of options to pursue in a career. The opportunities available range from working at a large company within their corporate finance department, to working for a financial institution or fund, or even working at a small company that deals in handling people’s individual finances. You’ll develop a foundation to understand the financial aspect of business. This means you’ll be able to find a position that helps analyze finances, evaluate markets, or even provide financial insight into transactions or projects.

The path most people trying to break into Finance take is to become a financial analyst of some sort. This is where you start to cut your teeth in finance and learn the industry. It’s the entry level position where you get your foot in the door, and start to really learn more about the industry you’re in.

An Analyst helps their superiors create the documents they need, research for the information they need, or put together the financial models or projections they need to successfully do their job. Every industry within finance needs an array of information and documents they need in order to move the project or deal along, and this is usually the Analysts responsibility.

In creating the documents, and learning what has to be done, it’s where you learn how the industry works, all the different parties involved in each transaction, and the basic fundamentals of the area you’re working in. It’s often a training a position and looked as a way to breed or develop a company’s hires. Based on your work ethic, drive, and quality of work, will determine a lot of how the company views you, and whether they value you.

Working your way up through finance has a ton of different positions or paths available to you. A lot of people go into finance looking to become a managing director or fund manager helping to manage or make investments into different assets. If you’re able to work your way up to CEO, MD, or PM, odds are you’ll be the one making the important decisions, and your opinion will be the one the company or firm acts upon. It takes a career of expertise, time, and experience to get there, but once you do the bonuses are high, and the tasks get very interesting.

Finance has a lot of small companies or individuals running their own firms, or their own money. Often times using other people’s money through institutions, endowments, or pension funds. People who are experienced and have proven track records try to make money for others who have it and look to take a piece of the profits for themselves.

There are also the people who work their way up at large companies and eventually become integral parts of a large companies’ operations or decision-making processes. Ultimately, its up to you to decide what type of career you want to have, and the company you want to work for.

A finance degree is a backbone, or a foundational element people often use to get into the finance industry. They use it to get their foot in the door and work their way up. The industry is based on hard work, time, experience, and expertise. The more you work in it, the more experience you get, the more you get out of it in terms of money and prestige.

A finance degree has a high change of getting your foot in the door within finance. Once you get your foot in the door, you’ll have the ability to work your way up.

Work Culture of Finance & Accounting

Finance

Working in finance is something to be prepared for. It’s an industry that deals with large sums of money, high pressure situations, and difficult people. The people in the industry are all trying to compete and make as much money as they can. They’ve had to be around and involved with people who are demanding, and exact to the little details. As an entry level person, you’ll be there to help the senior people make money and learn for yourself along the way. It’s an industry that’s filled with tight deadlines, high expectations, and high pressure in most situations. The competition among people in the industry, and people competing for the same business is some of the toughest you’ll see. It’s an incredibly competitive, and difficult industry to make it in, which is why the financial rewards are so big at the top.

Accounting

Working in Accounting is different than Finance. Accounting is an industry that’s more consolidated and focused from a corporation standpoint. The accounting industry has its big firms, and there all after the same type of business. Odds are a lot of the decisions and competition is at the higher level. As an entry level person, it’s a more relaxed work environment than finance, and often more of a 9 to 5 feel. You’ll have to get your work done, but the expectations won’t be as harsh, unless it’s close to tax season. Tax season is something to be aware of if you’re going into Accounting. When companies need to get their taxes in order, odds are you’ll be working much harder, and the environment will be a lot more tense. The people in Accounting are people who put in time and hard work to move up the ranks. There isn’t nearly as much intensity as there in in Finance. You’re more in competition against government or corporate deadlines, rather than competing firms. It’s a much more laxed environment with a lot of opportunity and positions available to you on the entry level.

Conclusion

Accounting vs. Finance is one of the most debated topics in regard to college or university major selection. People often debate whether one has more value than the other, and which they should get to put themselves in the best position possible to get a job after school, to the best industry to build a career in. Ultimately, it’s up to you to decide what you want to do. Finance is the industry where you have the opportunity to make more, and get more prestige, but also comes with more of a time commitment, more risk, and more intensity. Accounting is an industry that’s predictable and will always be around. Companies will always need Accounting services, and there will always have work to find with that background. The way to choose depends on the type of person you are and the type of career you’re looking for. If you’re someone who can handle the high intensity and pressure of Finance, it might be for you. But if you’re someone who wants to work with numbers without the intensity and pressure, Accounting might be for you. Ultimately, it’s your call, and to find and choose whatever is best for you.