What Does A Real Estate Analyst Do?

People who are starting their careers in commercial real estate often start out as a real estate analyst. The real estate analyst position is the entry-level position for the person who is fresh out of school, or new to the industry. It’s the position where you’re able to get your hands dirty and start to get a feel for the industry.

Most people set out to become a real estate analyst in order to learn and gain real-world experience in the industry. It’s important for anyone trying to build a career to start to get familiar and build their knowledge of information.

The position itself is geared toward understanding what’s going on in the industry or at the company and completing the various assignments that must get done, but most prefer not to do. As the new person on the block, who’s lowest on the totem pole, the work falls on you. You’ll have to do the things you find tedious or annoying, but that’s what the job description is.

It’s a position almost everyone has to go through and builds you a foundation of knowledge for your career. The best people know how to do all the tasks required and understand what goes into each number or calculation. As an Analyst, you’ll be the one doing the work, and inputting all the information.

What is the purpose of a Real Estate Analyst?

The main objective or task for a real estate analyst is to help provide support to complete whatever tasks are necessary. This often means assisting the senior team members in preparing and creating the documents they need. Every deal or transaction in real estate comes with a ton of information. Because most real estate deals are often large in size and money, so is the work that comes with it.

Each deal and each situation are going to be different. The different markets, the different programs, the different asset classes, there are a lot of variables that change from deal to deal. This means the Analyst must handle and compile all the necessary information to move the deal or transaction along.

As an Analyst, you might also have to lend a helping hand at times. This might mean helping another team out when they’re overloaded with work or helping to educate a new Analyst on the functions of the job. The Analyst position is one that acts as a stepping stone for your future and will propel your career in the direction you’re looking to go in.

What are the tasks a Real Estate Analyst might do?

- Research information regarding a geographic market

- Research information regarding the tax structure of a municipality

- Research the past rent trends within a market

- Try to forecast future rent growth for an asset class

- Gather necessary due diligence materials

- Create investment memorandums or deal summaries

- Input data into financial models

- Calculate and size financial models

- Make assumptions about the future outlook of a given market

- Gather the top employers within a given market

- Prospect potential clients

- Create marketing materials

- Complete term sheets

- Complete letters of intent

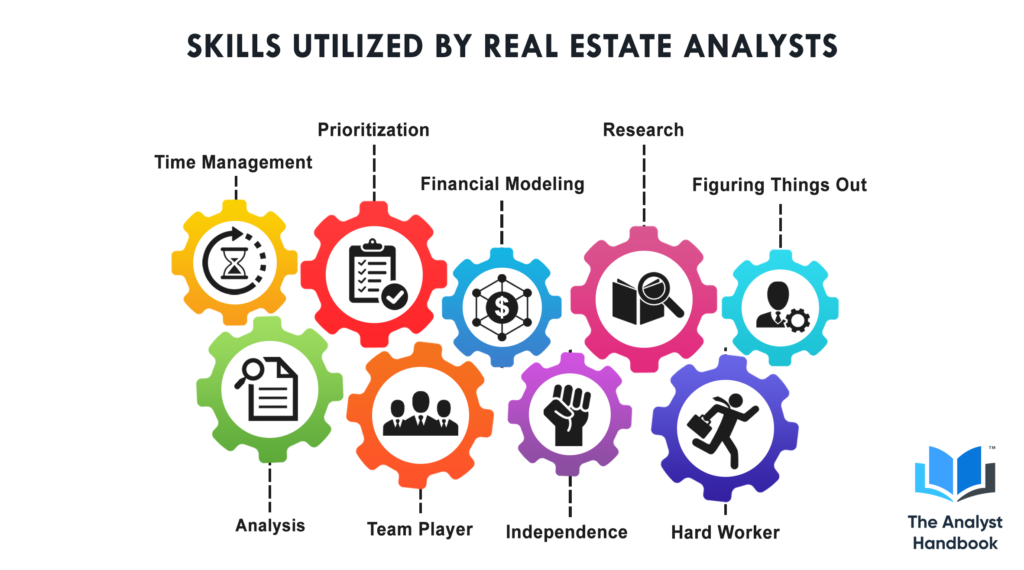

What are some of the skills utilized by Real Estate Analysts?

- Time Management

- You’ll be given a lot of tasks to complete and will have to complete all of them. Whether that means staying late, coming in early, or taking a 5-minute lunch break. It’s on you, the analyst to complete them, and it’s your job on the line. Managing your tasks and your time is one of the most important things as an Analyst.

- Prioritization

- Some tasks are going to be high in priority, and others aren’t going to be. Knowing which need to be completed ASAP, and which can wait is critical. This will make sure you’re working on the correct things and making sure the things that need to get done, get done.

- Financial Modeling

- Often times as an Analyst you’ll be tasked to complete a financial model for a project or transaction. This means being able to understand where all the data goes, what all the metrics mean, and the different assumptions that come with it. It’s something that takes time and practice but will come to you with repetition.

- Research

- A lot of deals and projects in real estate have tricky circumstances or intricacies associated with them. This means researching in order to find the answer or the correct information.

- Analysis

- Every deal or project you work on is going to require some level of analysis for assumptions or projections. It’s tough to find or get all the information or data you truly need. There will be some numbers you’ll have to analyze recent sales or sales comps for. This is especially true for the market comps, and the market metrics.

- Team Player

- Every deal or project is going to be a collaboration among many people and many teams. There is a lot that goes into real estate transactions from a legal, financial, and accounting perspective. Not to mention the people who are funding or sourcing the deal. Ultimately, it’s a big team effort, and a lot of parties are involved.

- Hard worker

- The amount of work you get as an Analyst is overwhelming. There’s a good chance you’ll be managing multiple projects and have time deadlines to match. The Analyst time is when you’re expected to stay at the office longer than everyone else and sacrifice the most of your free time.

- Figuring things out

- There are going to be times when you have no idea about what to do, and it’s up to you to figure it out. These are the times when you need to ask someone what to do or try and find out by researching online.

- Independence

- Any company that is going to hire you, is going to want you to become independent and be able to stand on your own two feet. If your boss or superior is going to have to continue to remind you about making the same mistake, and you’re unable to learn on your own from your mistakes, or questions, it’s going to be one rough ride.

What are the different asset classes Real Estate Analysts work in?

- Multi-Family: This is typically apartment buildings or units within an apartment complex.

- Office: This is typically referring to an office building that houses companies and business offices.

- Hotel: This refers to the different hotels, and operations that go with it.

- Industrial: This refers primarily to one story or large warehouse-type structures

- Development: This refers to open land or land that has yet to be developed.

What information goes into the documents or packages produced by Real Estate Analysts?

The documents needed within real estate depend on the type of company, and the area of the company you are working in. Every company and every transaction type has its own set of information that’s needed. Each project is different, and there’s going to be unique information for each deal or project.

What does this mean for the Analyst? This most likely means putting in the time and effort to understand what’s going on behind the deal. The small details that are only found by researching and spending time trying to research the deal like… is the deal in a flood zone? Does the deal have a tax abatement? Does the deal have rent restrictions? There’s certain information that can only be found by taking a deep dive into the documentation and reading through them. This falls on the Analyst. Most of the higher-level people are going to just want to review the work that’s been completed, apply their expertise and experience to it, and keep moving forward.

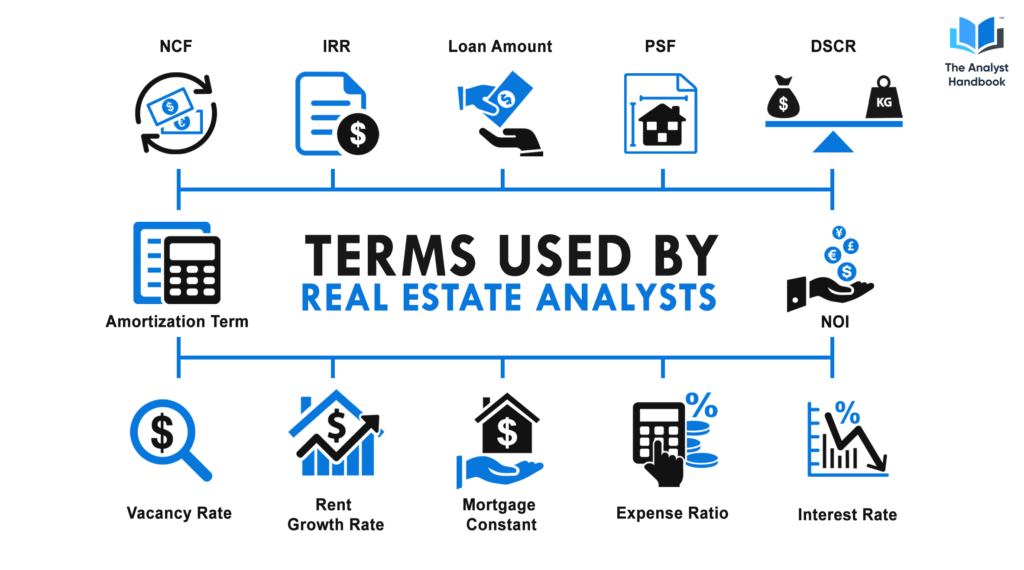

What are some of the terms used by Real Estate Analysts?

- IRR: This measures the internal rate of a return for a company. It’s trying to measure the return the company generates based on a discount rate yearly. Companies want to have an idea as to what an investment will generate in the future based on the information they have, the projections they make, and the assumptions they use.

- PSF: This is for the price per square foot on a property. Commonly used in office or development sites.

- Loan Amount: This is the loan amount you’re able to generate based upon the income or value of a property.

- NCF: This is the amount of net cash flow a property generates. After the expenses, vacancy, insurance, and reserves are taken out. This is the number that is used to calculate your total loan amount.

- DSCR: Your debt service coverage ratio shows you how well you’re covered to pay your debt service. It’s a number that’s based off your debt service payment and your net cash flow. Banks like to see net cash flow numbers that at the bare minimum cover the payment, usually prefers 1.30x and higher.

- Mortgage Constant: Your mortgage constant is the amount of interest and principal you’re paying. Depending on the amortization period, the loan amount, and the interest rate will determine the mortgage constant.

- NOI: The Net Operating Income is the amount of money a property generates after factoring out its expenses, vacancy, taxes, and insurance. It’s the metric that’s used primarily when sales are made or conducted.

- Vacancy Rate: The Vacancy Rate is the percentage of the property or space that’s vacant. If a space is vacant, it isn’t occupied, leased, or rented.

- Interest Rate: The interest rate is the amount of interest you pay on the money you took out as a loan or are due to pay back over the life of the loan.

- Amortization Term: The amortization period is the amount of time you’ll pay off the loan amount’s principal balance.

- Rent Growth Rate: The rent growth rate is the amount of growth you project the rents to have. Often linked to the market’s rent growth rate.

- Expense Ratio: The percentage of income you pay in expenses. It accounts for all the expenses you have to pay to run the property.

The paths available to Real Estate Analysts

Going into real estate as an analyst will put you on a path within the real estate industry. Starting out as an analyst, you’ll gain the experience and knowledge you need to move up the ranks. A lot of people who are senior-level at big companies started out as analysts. Companies like to invest in their employees and groom them into higher-level employees. The path available to many analysts exponentially expands once they get the promotion to associate.

The associate promotion makes you a hot commodity in the recruiting market because now you’re considered trained. Companies won’t have to invest the same amount of resources, time, and energy into you as they would someone fresh out of school. This way, they can focus more on molding you, and teaching you how they like to do things, rather than have to also teach you the basic fundamentals.

Other paths available are to work your way up to a vice president, director, and managing director. This will depend on your work ethic, and you’re ability to produce. Building great relationships, and getting the company to believe in you, can be some of the best ways to rise up the ranks.

Conclusion

Real Estate analysts are an essential part of the commercial real estate industry. A lot of what they do is at the core and center of what’s needed in real estate. Every transaction or deal is incredibly complex, and the documentation required to move deals along is intense. Odds are you’re dealing with the exchange of millions of dollars, and there is a lot of work to be done before any of that happens.

The real estate analyst is the one who gathers all the information and puts it into a format or package that the company or executives like to analyze. This way, they can see the important data and metrics, then use their knowledge and experience to make high-level decisions.

The position teaches you about the industry and the common practices that are utilized. You’ll start to learn the nuances associated with real estate, and the different procedures that are in place. Every team, every company, and every subsector within the real estate industry has different policies and procedures in place. It’s a position that helps you build your foundation as a real estate professional, and teaches you a lot about the real estate industry.