What Is Corporate Finance?

Corporate Finance is a term that covers an array of different topics, areas, and tasks. A general term, corporate finance deals with the way a company or corporation handles their finances. Meaning their books, their investments, their financial calculations or projections, and any other of their financial projects. The health and well-being of a company is heavily dependent upon the way they handle their finances. A company that’s in financial trouble, or in weak financial standing is going to have a much tougher time performing and operating. Corporate Finance touches upon the financial decisions a company makes, which play an important role in the success of the company, the company’s performance, and their financial standing.

Companies are generally created to find ways to make money, increase their revenue, and increase their valuations. The way companies are able to do this, is by finding ways to increase their top line revenue, reduce their expenses, or find more ways to become profitable. Large corporations often have many different income streams, product lines, and offer many different services. Figuring out what works best, and produces the optimal level of profit, revenue, and growth is something that takes some time. There are often many different calculations or projections being run. Various models trying to predict or analyze the state of the company’s finances. And the different options companies have available in order to grow their companies or find ways to enhance the company’s operations.

In order for companies to be able to do these types of things, they need to have people in place to evaluate, analyze, and understand the current state of affairs, and the best ways to move forward. Insert corporate finance. The corporate finance department or people are often trying to depict what’s going on at a certain company, certain production plant, or with a certain offering, whether it’s a product or service. They’re trying to gain an understanding of what’s going on, what can they do better, where is their room for efficiencies, or where they can help increase the company’s profitability. Underneath the numbers of the operations, and the statistics that make up the company, is information on what’s working, what isn’t working, and what can be enhanced to capture more growth.

Large Cap or Large Corporations

Big companies often have lots of different products, services, and offerings available. Depending on where you’re located within a company, and the type of financial data you’re going to have will determine the type of work you’ll be doing. Some companies have corporate finance teams for individual products or divisions, or they have corporate finance teams for the whole company, corporation, or individual company, or corporation. The type of work you’ll be doing, and the way your company will be situated will be dependent on the type of company you work for, and the way their operation is set up.

Large companies and corporations often times have proven, steady, and strong business models. Whether they have a strong place in the market, or a proven product, odds are the company is going to have a proven revenue or income stream. They’ll have a history or a record of the types of past performance or operational results to utilize and to use as a benchmark.

Each company, each business, and each division will have different needs from a corporate finance perspective. Some may need product release numbers, others might need investment returns for real estate or new equipment, and other’s might be to evaluate the fluctuations or changes in inventory levels, and the types of financial effects. Large companies or corporations might want to evaluate a new market, whether it’s worth entering, the type of returns it can predict, and the business effects as well. The corporate finance team for a big company will be different than those of smaller ones, as the numbers will be bigger, the markets will be vaster, and the data will be wider stretching.

Medium Cap or Medium Sized Companies

Medium sized companies’ financials and financial projects can be different than the larger companies’ projects. Many times, medium sized companies are trying to find ways to grow their businesses, capture more market share, or find new markets to enter into. The type of projects or assignment you’ll have will depend on the company, the markets they’re involved with, and the type of future or past performance they’ve had. A medium sized company will hopefully have a proven business model, or products that produce steady and stable income. Hopefully you’ll be able to be a part of the company’s growth and continue to work on developing or increasing the company’s business.

There’s a good chance you’ll have increased flexibility and be able to cover more areas or be involved in more tasks or assignments at a medium sized firm versus a large one. Odds are the large one is going to be more specialized, have more personnel, and differentiated by different products, services, or offers, whereas a middle sized company, you might have less personnel, which gives you more of an opportunity to touch on more products, services, or industries as well.

Small Cap or Small Sized Companies

Smaller companies or smaller corporations usually have a finance person, or someone who handles the financial side or aspect of the company. Odds are the person in charge of finances, might be the owner, or a closely trusted advisor. Working for a small company within their finance or corporate finance division, will mean increase exposure to more product lines, a wider range of responsibilities, or more of a hands-on approach. You might be able to speak with or directly impact the company’s finances or operations by speaking directly to the people involved. With a large company, you’re probably analyzing or evaluating the results or numbers from many different locations, markets, or industries, making it difficult to speak with the people directly involved or directly participating in the company’s performance. You might be trying to figure out ways to capture market share from competitors, find ways to reduce costs or expenses by finding new distributors or suppliers, or you might be tasked with increasing their operational efficiency by finding cost cutting measures. At a smaller company, you’ll be working on a wider range of projects and tasks, as it’s likely there are less people involved, with less of a specialization than at a bigger company. You might be involved with all aspects of the business, each individual or specific product line, or each service the company or business offers to its clientele. This means you’re able to learn more, be exposed to more aspects of the business, and gain a better understanding of the way the company operates. At a larger company, it’s tough to get a real sense of what’s driving business, the contributing factors, and the important numbers involved. At a smaller company you can be situated or directly in contact with each key individual or personnel member involved.

Different Types of Corporate Finance Projects

Projections

Each product, service, or offering, has a set of projections in place, or a set of predictions the company believes will be achieved, or will be close to achieving. Depending on the market the company is operating in, the past performance the company has seen, and the type demand a company anticipates, will determine the types of projections a company believes they might be able to achieve. Depending on the way the company wants to forecast, whether it be aggressive or conservative, you’re able to get an idea or a sense of what the future might entail. This means the type of revenue the company will generate, the number of users or customers, and the type of growth they forecast they’ll be able to capture. The projections a company creates and believes in, often act as a baseline to measure the company’s performance, or to give the company an idea of what they can expect the product, service, or offering to produce in the marketplace.

Projections are an important part for many businesses, as it gives high level executives an opportunity to analyze and evaluate the success of a product or give them a guideline as to what to expect. Each company analyzes and projects in the ways they see fit, but many times it’s the corporate finance department who’s tasked with creating these projections and finding the research or intel to support their assumptions, opinions, or hypothesis.

Research

The work you do in corporate finance, is heavily determined by the types of numbers you use, the sources you have, and the support behind it. Within finance, and corporate finance, there are times where you won’t have all the information, data, or evidence you’ll need in order to put together a model, a calculation, or a projection. That’s where the research comes in. You’ll have to find sources, publications, or people to support the assumptions you make, the hypothesis you have, and the variables you’re projecting. Within corporate finance, it might mean the type of growth forecast you use, the projected cost of a project you anticipate, or the type investment a certain product or service is going to need.

The types of research you’ll have to do and the numbers you’ll need to find will vary with the project or task at hand. The important part is that you have factual evidence, or credible sources to support the logic you have, the information you’re displaying, or the analysis you’re presenting. The work you produce will often be reviewed by others, whether it be your boss, higher ups, or clients, and having the research or the evidence to support it will provide increased credibility, and confidence to the people reviewing or analyzing the information being presented.

Financial Models

Financial Models play hand in hand with projections, as it’s a more complex and detailed prediction or projection for the future. A financial model is able to take into account a variety of different variables, a variety of different calculations, and use several different formulas in order to give a company an idea of what to expect. You’re able to calculate and predict what a certain situation will look like based on several variables, assumptions, and data points. Many financial models are interconnected between their calculations and formulas. It allows you to see what will happen if one number changes, the type of effect it’ll have another. It gives companies the ability to see the end result, under many different variables, assumptions, and situations that may arise in the future.

Companies are able to get a detailed and a concise idea of what a certain product release might look like, the type of return an investment is going to generate, or the type of market share it’s able to capture sometime in the future by using a financial model.

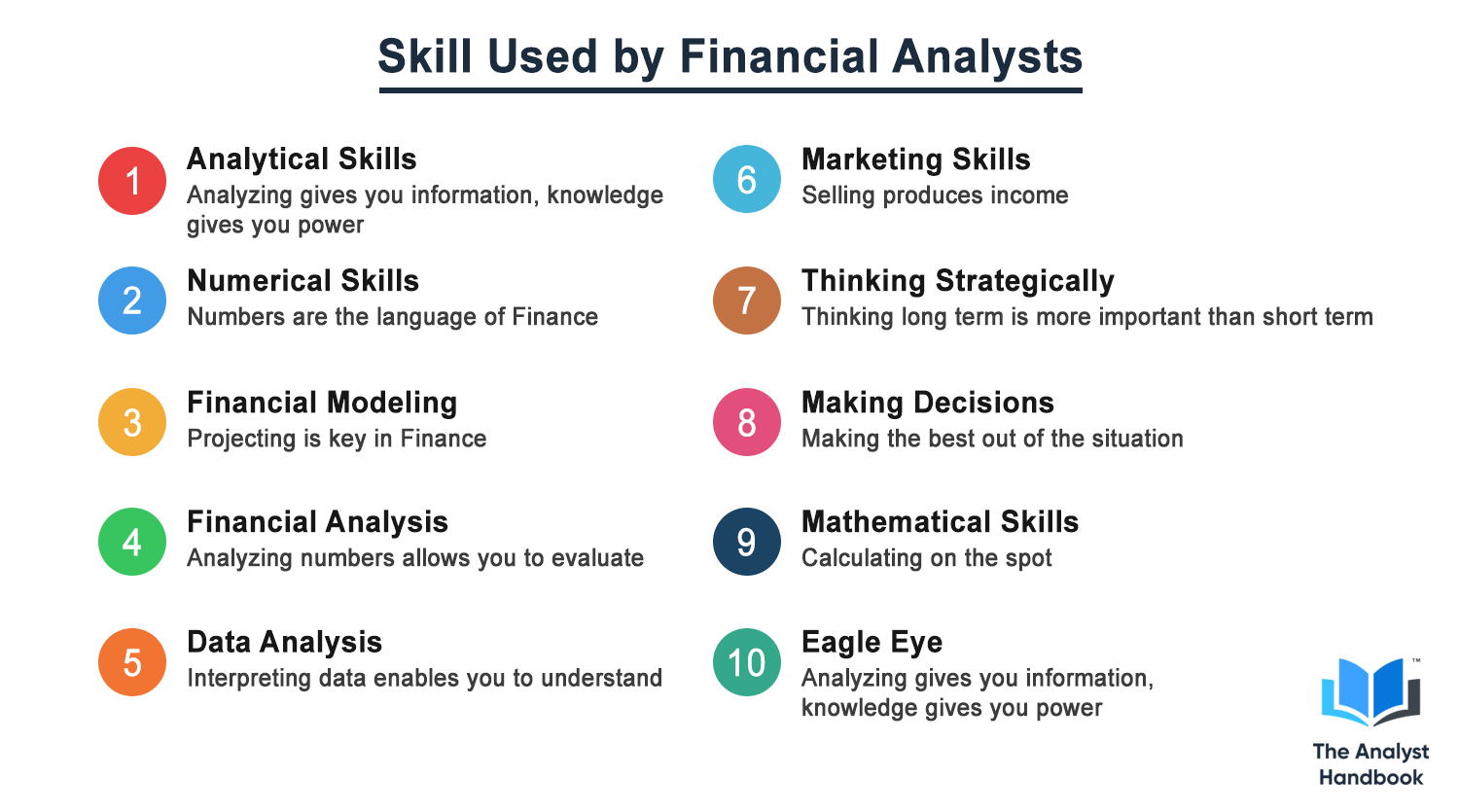

Financial Analysis

Within corporate finance, financial analysis is an incredibly important element. Knowing where to invest assets, where sales are strong, and where the company is performing well is crucial in understanding and implementing the knowledge you learned from the data. The past performance of a company gives your insight into the best ways to move forward, it shows you where your product or service performs best, where a company should allocate its resources, and the types of markets where the company performs well.

Analyzing a company’s performance, operations, or productivity gives you intelligence and data into how the company has operated, and it’s current state of affairs. Seeing the type of revenue, a company produces, the types of changes in growth for different months, and the way the business has developed over time gives you very valuable intel into the company. You’re able to see the different patterns in operations, any types of seasonality, and the different trends over various date ranges. You’re able to understand what works, what doesn’t work, and what’s happened as a result of certain decisions. It gives you great insight into the best paths moving forward and replicating what’s worked in the past.

Market Analysis

A lot of business is catering to the market you operate in and addressing the needs in the marketplace. The numbers behind a company, the data corporate finance personnel analyze a depict is based off an individual market. For corporate finance people, they’re able to see which products perform better in certain markets. Each market has different preferences, different desires, and different wants and needs. The better a company understands the market it operates in, the more it can enhance or upgrade its offer to better the suit the market, hopefully generating more revenue and increased income.

The outlook a market has, or the direction it’s going in is important for corporate finance. They’re trying to help the company position itself capitalize on future growth or for a market expansion, or to help predict a reduction in a certain market or in a company’s revenue. Anticipating these types of market moves can be incredibly important for a company’s overall health, and it’s financial standing especially during a downturn.

For corporate finance, understanding the size of a market, gives you insight into the type of revenue you can generate, and the type of market share you’ll be able to capture. You can project or predict the type of value a certain product or service can generate based on its market size, and its customer base. You’re also able to see the types of length between purchases, the purchase cycles, the types of customer lifetime values, customer retention metrics, and the cost of each customer. All of these metrics are important for both the marketing divisions and corporate finance divisions to see what a customer is worth, to see how much it costs to acquire a customer, and to try to predict the type of future income or revenue a company is able to generate.

Analyzing the Competition

The businesses or companies your competing against, has an effect on the type of revenue you’re able to generate, and the other options available to potential customers. The products they offer, the services they have, and the market share they have are important to consider. You can see the type of revenue or income that’s available within the marketplace. You can see how a company or corporation stacks up in the market. The type of market share they have, why they have their market share, and how to figure out ways to capture more of it.

Within corporate finance, understanding the data or the reasoning behind certain metrics often comes down to understanding the competition and the customers. By seeing what does well in the market, the types of features or benefits, and the advantages of high performing products you’re able to judge the different products, or services available, including the company you work for, or the one you’re analyzing.

You’re able to see what drives a company or products success. Whether your company needs to improve, enhance, or elevate what their offering, based on what the competition is offering. Analyzing the competition is a valuable resource that can provide incredible insight into the metrics and data of a certain market, product, or service. You can see the driving factors behind markets, company’s success, and the data surrounding a company.

Valuation

Valuing a company, an investment, or a project requires you to analyze a variety of variables, have market knowledge or information, and making a few key assumptions. Valuating works hand in hand with financial modelling and financial analysis. Part of financial modelling is to figure out a value or to assign a value to a certain project, investment, or company. One of the main elements of valuation comes down to the market, where the market stands, the type of price or value the market would pay, and the future outlook for the investment.

Depending on the type of asset or investment you’re analyzing, often times company’s look to recent comparable sales or transactions, they try to use past performance to project, and they try to create a future value for the investment based on any future movements or changes within a market. It’s tough to predict where the market is going to be in 12-18-24 months or even more, but it’s part of the process of valuation to use educated hypothesis and any research that’s available.

Within finance, one of the main elements of valuation is something today is more valuable than something tomorrow. The future value of something may be higher or increased based on a variety of factors, but companies tend to discount the future value by a certain discount rate. The discount rate varies in regard to the industry or the investment, sometimes it’s the cost of capital, the opportunity cost, or simply the average rate of return. By using future cash flows or future value the company may generate, in addition to a discount rate, you’re able to figure out the internal rate of return for a project. That shows you the return from a project based on the amount of cash it returns to the company, any discounted future cash flows, and in the present moment. You’re able to get a real indication given all the expenses, the income, and other factors as well what the company can expect to generate or make from an investment. A lot of this is also used in DCF or discounted cash flow valuations as well.

Budgeting

Budgeting is a very interesting element to business and an important element to finance. In the process of creating a budget, you see the types of variables at hand, the type of elements that may affect the company or market in the future, and the belief or the expectation the company has for the project, investment, or company. Taking into consideration all of these factors, the budget is created to help give a framework, or a baseline for the company. To see how the company’s performance measures up to the initial expectation. To see what kind of variants or deviants there were to the budget and why.

Creating a budget has lots of components to it. Whether the company is aggressive or conservative by nature, the type of outlook or view they have on the market their operating in, and the expectation the company has for its production and performance. Looking into the future and trying to predict the type of events and production the company might endure gives the company and its executives a framework or a baseline to have. It creates the initial expectation or the initial prediction for the company and its performance.

You’re able to use the budget to see whether a project is overbudget, whether a company is exceeding expectations, or whether a company is underbudget, or performing less than expected. It’s a great tool to see where the company believes performance is going to be, and the types of results it believes it’s going to achieve. You’re able to use it in the beginning and in the past as well. You can see how the company’s performance stacks up against the initial budget, and compare the budget of this year, to any prior years as well. Without a budget, it’s tough to have an idea, or a baseline for a company or a projects operation or performance.

Conclusion

The term corporate finance covers a variety of different topics, areas, and assignments that involve a company’s finances. Within each company, there are lots of tasks and projects that touch upon a company’s finances, the financial standing of the company, or the financial performance of the company. Many companies have teams or departments who try to evaluate the financial effects of certain decisions, and which paths are the best to move forward.

The decisions a company makes, whether it be pertaining to a specific product, service, or market often have financial effects on the company. Whether it be investing a portion of its assets, increasing the number of people on a project, or the type of future return a project might generate, there are lots of factors a company must analyze and evaluate before moving forward, and during its operations.

Companies large and small, have to find ways to handle and figure out the finances behind their operations, their investments, and their performance. With larger companies, the decisions might involve larger numbers, bigger investments and larger returns, but many of the same or similar concepts apply to smaller businesses as well. Smaller companies might find their corporate finance people or team to have more of a hands-on presence, learning more about the company, and have a wider range of projects to work on. Larger companies often have more specialization, or teams who are dedicated to specific projects or tasks. Smaller companies might have one or a few people who handle all of the company’s finances, or financial projects.

The types of projects the corporate finance team or personnel might find themselves doing depends on the tasks at hand, the market the company is in, and the types of projects the company is undertaking. You might find yourself doing financial modelling, competitor analysis, or creating a budget to act as a guideline for the company’s operations. These tasks often play a role in finding a solution or an answer to the problems or questions the company might be looking to solve. Entering new markets, valuing a certain project or company, or researching more about a specific topic or industry to put together projects or an analysis to help the company better understand what it’s considering, all types of tasks someone on a corporate finance team might find themselves doing on a day to day basis.

Corporate finance is an ever evolving and changing term that applies to companies, businesses, and investments in their own unique way. Each company has a variety of different tasks, agendas, and assignments they are trying to handle and figure out. The finance team, or the financial personnel are tasked with learning more about the current situation, and providing research, evidence, or feedback to the company. The people within a corporate finance position or team are often handling the types of financial implications, the financial results, or the financial changes decisions, projects, or investments might entail for the company.

We hope you enjoyed and learned a bit more about the term corporate finance, and what it means to each company. We wish you all the best, and much success in your future endeavors. Keep going.