What is Real Estate Investment Banking?

Real Estate Investment Banking is a term that covers a variety of different topics and different areas within both Real Estate and Banking. Depending on the company, the asset class, and the team, the projects and tasks may vary. It primarily involves the debt or equity within a Real Estate transaction. Whether that means issuing debt through new bonds or raising new equity through share issuance for a REIT or raising capital from institutions on behalf of a developer, Real Estate Investment Banking is heavily involved in the debt, equity, and structure behind transactions.

As Real Estate has jumped in value, wall street and the banks have followed in their footsteps. The major banks and banking institutions have become major players within Real Estate and have been a major part of the Real Estate industry. Banks have been lending on Real Estate for a long time, but they haven’t been nearly as involved as they are now. They have become major players in the financing and capital stacks that are behind many of Real Estates’ transactions.

The Capital Stack

Real Estate is a capital-intensive business that requires a high level of investment and capital to participate. Depending on the city you’re investing in, the asset class you’re pursuing, and the type of deals you’re looking to purchase, the numbers are commonly in the tens of millions, if not the hundreds of millions of dollars. Most people or companies don’t have that type of cash or capital laying around, therefore they have to figure out a way to raise the capital, in order to purchase or move forward with the deal.

Many financing companies and banking institutions have become major parts of Real Estate transactions capital stack. Depending on the type of deal, and the asset, they’ve begun to play major roles in the facilitation of both the debt and equity behind deals.

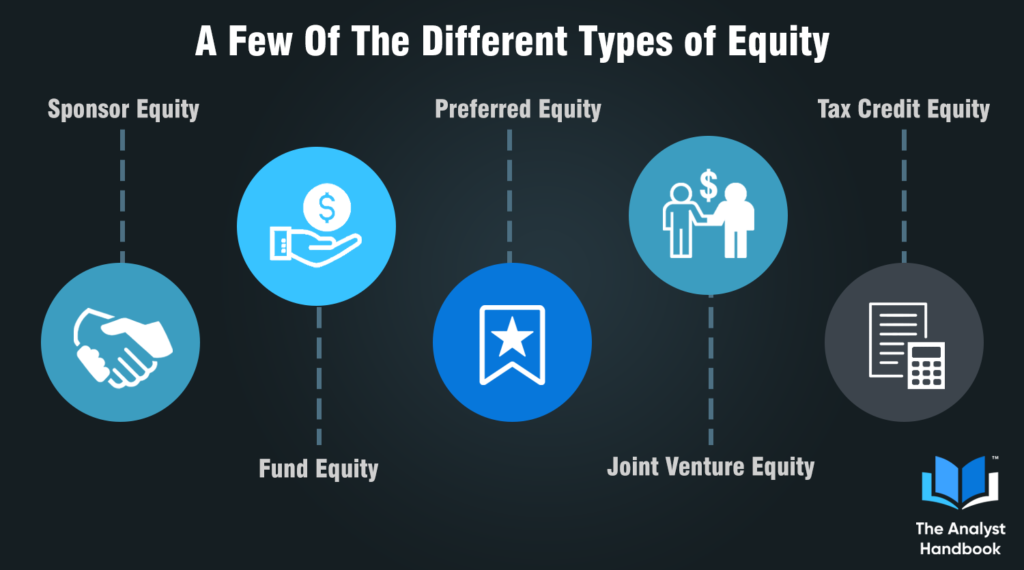

Equity

One obstacle that’s involved with investing in Real Estate and putting a deal together is the equity. The equity is the amount of money the developer, or the property owner is planning to invest in the property in order to secure financing, or in order to move forward with the transaction. Many developers and Real Estate companies pursue very expensive, and capital-intensive projects, that require large amounts of equity.

There are a variety of ways that banks, developers, and financing institutions play a role in helping bridge that gap…

Sponsor Equity

Sponsor Equity is generally when the developer, owner, or prospective purchaser provides equity out of their pocket, or from their own capital source. So what we mean, is they’re able to fund the project themselves, and use the money they already have, or are planning to have by the time of the closing. Many times, when smaller Real Estate transactions take place, or when experienced Real Estate operators purchase a deal, it’s with their own equity. This way, they have no partners, no one to answer to, and it’s 100% their deal and project. Depending on the prospective purchaser, or the person who’s buying the Real Estate will depend on where their equity comes from if they’re able to supply it themselves or turn to other capital sources to raise the equity needed.

Fund Equity

Real Estate Developers, Owners, and Operators, often raise capital in the form of a fund. This means that institutional-level capital, whether its endowment funds, institutional funds, pension funds, or various other large capital sources, invest their money into a certain firm, company, or transaction. Real Estate Companies or Investment Banks will sometimes mediate this process and help one side or the other connect with the parties they’re interested in partnering with. Depending on the fund, and its criteria, some financial institutions will be able to direct or help companies raise the necessary capital they need, through their banking connections and relationships.

Preferred Equity

Institutions sometimes invest in a project in the form of preferred equity. Banking institutions will invest money or capital into a project that’s higher risk than debt, but also higher reward. This money is considered equity within the equity portion, meaning it’s the last party to get their money out, but their ability to secure a note at a higher yield than a debt piece. Essentially, companies will invest equity into deals, in exchange for a 3%-6% higher yield than what the project is paying its lending partners. This way, you have a bit of a vested interest within the deal, but you’re also acting as more of a lender, getting a pre-determined yield on the money you invest.

Tax Credit Equity

Some Real Estate transactions and projects, primarily affordable housing, are often incentivized by tax credit equity. Developers are given tax credits from the government, in exchange for keeping rents at affordable prices, and at below-market prices, and then are able to sell those credits to most often financing or banking institutions in order to raise the necessary equity they need to do the deal. The financing or banking institutions will purchase the credits from the developer, usually at a bit of a discount, anywhere from 1%-15% below their face value, and use them on their balance sheets, and help reduce the amount of taxes they pay to the government. This way, developers are incentivized to keep rents low, banks are incentivized to purchase the credits to reduce their taxes, and the government is able to provide its citizens and population with lower-income housing.

Joint Venture Equity

Some large institutions and capital providers, are often interested in investing in Real Estate, but would not like to be the owner, operator, or the person handling the day to day operations. These large institutions often see Real Estate as an attractive investment but would like to take a bit of silent investor position, and a secondary position to the managing member, or the general partner. These institutions often invest enough capital to obtain roughly 49% of the equity and let the general partner keep 51%, the controlling interest. Banks and Financing Institutions will sometimes help facilitate these types of transactions by connecting two interested parties, as well as sometimes invest in the deals and real estate transactions directly.

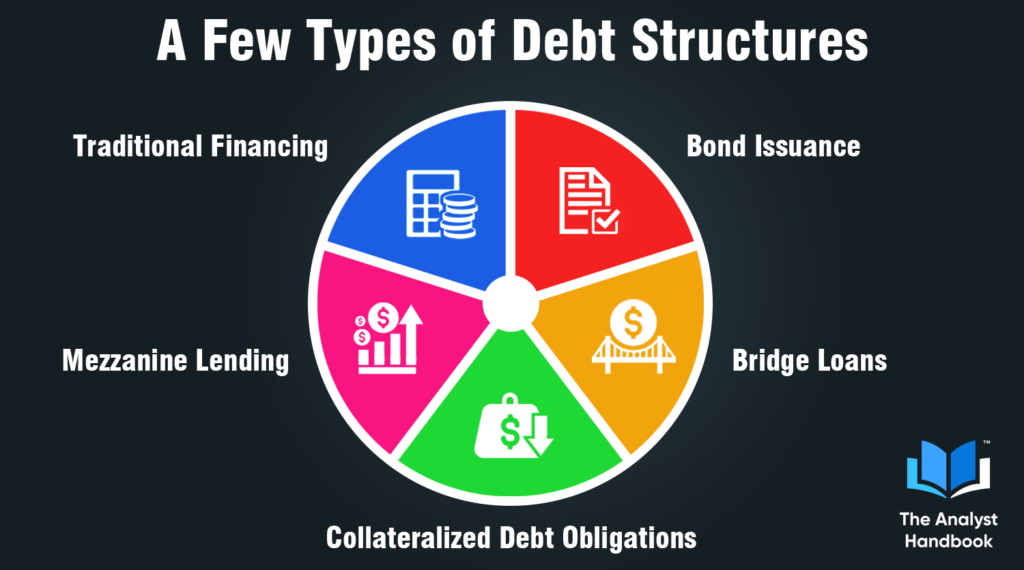

Debt

As the world of finance has become more and more complex and intricate, the various ways banking institutions are able to administer and provide debt has grown as well. Banks and financial institutions are able to provide capital to developers and prospective purchasers of Real Estate in a variety of different ways, all of them being considered debt.

Traditional Financing, Regular Mortgages or Senior Financing

Most Real Estate transactions, often use a mortgage or financing in order to meet the capital requirements of a deal. In exchange for the banks’ capital upfront to help the owner secure the Real Estate, banks contractually receive a yearly return, anywhere from 2%-20% based on the type of deal, and the borrowers. The banks analyze a variety of different metrics, including net cash flow, loan to value, capitalization rate, and many more, in order to determine the amount of capital their willing to lend on a certain property. The banks and financial institutions have to get comfortable with the asset itself, the borrower, and the future business plan for the property before they lend their capital for a transaction. They are an important part of any Real Estate transaction, as their money is the most senior, and the first out, in the event of a foreclosure, or inability to pay the mortgage. They have to be comfortable at their lending basis, and willing to lend their money to the prospective Real Estate developer. Their money is the first one out in the event of a sale, before the equity, and right after the government’s taxes. Traditional Mortgages or Senior Financing is often referred to as being in the first position.

Bond Issuance

Depending on the lender, and the provider of the notes, often determines the type of bonds administered. If a REIT is administering notes or debt to the public, it’s often trying to raise equity for their business or for a certain reason in exchange for a yearly yield or dividend to its investors. There are various markets that are available to Real Estate Owners and Operators, if you’re large enough and you’re a REIT, you have direct access to the public markets. Often giving the lowest yields on notes and making the money or the capital the cheapest to get. There are also other markets, around the world, which will administer notes or debt in exchange for a pre-determined return. Depending on the investor, the project, and the finances behind the project, they often play a major role in the type of yield the investor has to offer or pay in order to attract investors or capital providers. There are also the government institutions that administer bonds or notes to the public or to investors in exchange for equity. If a project has a government component or is subsidized by the government in some capacity, it’s possible that the government either sells the bonds for the Real Estate owners or provides the bonds for the Real Estate owner to sell or place on their own to raise the capital. There are a variety of different ways, structures, and markets that are available to Real Estate owners and developers to help them raise equity through the issuance of bonds or notes.

Mezzanine Lending

Certain transactions need additional funding or capital in order to make it happen. When this happens, mezzanine lending is utilized in certain transactions. Mezzanine Lending is often the second or lower level of the financing that’s involved in a project’s capital stack. The Mezzanine Lender is often paid a higher yield percentage than the senior level financing piece, in exchange to get their capital in the second position. This means, should the project go belly up, or when the project concludes, their money comes out second, after the senior level piece. Companies and Banking Institutions will invest their money in the lower level pieces or tranches, in order to generate a higher yield on their capital or on their investment, than the senior lender. As with an investment, the higher the return, the higher the risk. This means, the Mezz piece or Mezz lending often comes with more risk than the lending in senior or first position. Since you’re behind someone else in the case of a foreclosure or lower profits than expected, your money is at risk and is more likely to be wiped out than the senior lenders.

Bridge Loans

Some Real Estate transactions often come with a bit of complication, or a bit of hair attached to them. What we mean is, there’s often some problems or some issues that need to be figured out before permanent or senior level financing is comfortable lending on a project. Often times, this is where a bridge lender or a bridge loan comes into place. When a property is highly vacant or needs a lot of improvement in order to get it up and running, senior lenders won’t be very interested in lending on this type of property. The purchaser or owner still needs to figure out a way or find a way to raise the necessary capital or equity to fund the improvements and make the necessary changes to get it where it needs to be. Bridge Lenders often fill the space, by providing shorter-term money or financing, that sometimes comes with strings attached, and a higher rate of return than what senior-level financing charges for their capital. The owner needs to get more tenants into space or to upgrade the space to get it to a point where tenants are interested before a senior lender is going to be comfortable providing a loan. Banking and Financing Institutions who provide these types of loans, often want to be very familiar and comfortable with both the Real Estate owner, and the business plan the owner plans to use. They are taking much higher risk than most lenders would, and in exchange, they want to be compensated for taking on that risk. The loan often comes at a 2%-15% higher than what a senior lender or permanent financing might charge.

Collateralized Debt Obligations

In recent years, some of the most common types of financing available and financing options have been collateralized debt obligations. Collateralized debt obligations sound complex and intricate, but once you dive into it, it’s pretty straightforward. Some companies put together the loans they have, or bring in, and sell them off to investors, the public, or other people looking to invest in Real Estate loans or mortgages. Companies pool together a group of financings or mortgages, depending on a certain criterion, or depending on the company, and offer them out to investors based on a certain yield projection, or based on the type of loans involved within the offering. A lot of the times, the offerings, and cdo’s, are incredibly large in size, hundreds of millions, and offered to a variety of investors, often hedge funds, private capital providers, and investors who purchase them. There’s a third party or a special servicer, who acts as the intermediary between the two, and who coordinates all the payments, mortgage payments, and many nuances that are involved. It’s a complex way for companies who create loans, sell them off to other investors, and shift the risk away from their balance sheet, and their portfolio. They’re able to continue to generate the fees associated with the loans but sell of the risk and the exposure for the life of the loan.

Other Areas of Real Estate Investment Banking

REITs: Creating and Constructing a REIT

Companies who have a big enough portfolio, and strong financial standing, often times have the option to become a REIT. Becoming a REIT is tricky, and a difficult process, that requires the company to comply with government regulations, and standards they haven’t had in the past. Creating a REIT, or the construction of a REIT is most often done with the help of a third party, or an experienced company that’s done it before.

Depending on the size of the company, and the structure the management elects to pursue, it will determine the type and size of the number of shares issued. A lot of companies have their eye on becoming a REIT, because it gives them access to the public market, decreases the cost of their capital, and increases the level of liquidity. By going public, many companies look to increase the size of their portfolio and help fuel any ideas they have for expansion.

M&A: Mergers and Acquisitions

Another part of Real Estate Investment Banking is Mergers and Acquisitions. Companies will sometime acquire or try to acquire other REITs or other publicly traded Real Estate companies. Depending on the type of the transaction, whose purchasing who, and the type of equity or the financial wherewithal being exchanged will play a role in the transaction. Investment Banks play an important role in the facilitation of companies acquiring, merging, and selling each other to others because it’s an incredibly complex, and intricate process. There are many nuances to be figured out, the type of management of a new company, the structure of the transaction, any accounting or tax implications, and much more. Depending on the transaction, and the companies involved will often determine which Investment Banks (possibly their Real Estate division) are involved and if there are any Real Estate Investment Banks in particular.

Advisory

There are some companies, Real Estate Investment Banks, Investment Banks, and Real Estate Companies who provided advice or play advisory roles to company’s or in transactions. Depending on the type of transaction, and the type of advisory necessary will determine the role a company may play. Many times, Real Estate Companies, or operators, will look to third parties or other companies to help them with due diligence packages, figure out the right way to structure a transaction, or any guidance or help to point them in the right direction. Real Estate Investment Banking is often an incredibly high priced, and large dollar industry. For companies to transact, and structure the deals in the correct way, it often involves many parties and lots of coordination between the groups.

Conclusion

Real Estate Investment Banking is a general term, that could have many meanings, and involves many different types of deals, transactions, and arrangements. We tried to outline the few that we’re aware of, we’re sure there are more, and much more items to cover that are considered Real Estate Investment Banking.

The Real Estate game is often divided up into two, debt and equity.

The Equity side involves the amount of money a company or partner decides to invest in a deal. Many times, the way the equity is structured, or the arrangement companies have, is incredibly intricate and complex. Depending on the type of deal, the type of requests, and what the parties are comfortable with, will often the type of equity that’s provided in a deal, or for a transaction. Sometimes it’s joint venture equity, tax credit equity, raising a fund, or preferred equity. There are a variety of ways to structure a Real Estate transactions equity, we only covered a few of the many.

The debt side of a transaction is providing financing, or leverage, based on the type of deal, and the type of borrower. There are many different types of financing, and many financing options available to you. To name the few we covered, traditional mortgage financing, issuing notes or securities backed by assets or collateral, mezzanine lending, bridge loans, and collateralized debt obligations. There’s a variety of different ways, different products, and different areas within the debt side of Real Estate Investment Banking, each depends on the company, the team, the product, and the structure of the project.

Many of the aspects of Real Estate, can be considered within Real Estate Investment Banking. There are some companies that label themselves as Real Estate Investment Banking Companies, some who label themselves as Real Estate Capital Markets, and there are some financing institutions that have Real Estate divisions within them. Each company is different, and the way companies are structured depends on each company themselves, and the type of programs or arrangements they have. We hope you were able to gain a bit more insight into the incredibly broad term of, Real Estate Investment Banking.