The Complete Investment Banking Analyst Guide

A career in Investment Banking starts with a position as an investment banking analyst. This is where students and new hires start their journey in banking. This is a basic, entry-level position in order to get into investment banking. The position below, an analyst, is a summer intern.

It’s estimated 90% of an Investment bank full-time positions go to the summer interns who worked there the previous summer. This enables them to get to know the candidates, see how they work, and if the can handle the workload that comes with being an investment banking analyst.

To become an IB Analyst, one has to go through several rounds of in-depth interviews, and intense super days (typically an on-site at one of the investment banks’ office locations).

The work an banking analyst does is not necessarily inspiring, but it is important to the firm and its operations requiring precision and dedication. A typical investment banking analyst will work around ninety to one hundred ten (90-110) hours a wekk, including a lot of evenings and weekends.

Best Undergraduate Degrees For Investment Banking

Competition for investment banking analyst positions is incredibly difficult. There are tens of thousands of applicants for a select few positions. Breaking into the industry is much easier if you have a degree related to business or finance.

Investment Banks like to see a candidate whose course work is involved with finance, money, or business. This way they know you have a solid foundation of business principles and fundamentals underneath you before you start. It’s important to have a sense of what is going on in the business, how the different financial statements are interconnected, and how the economy functions.

It also shows you have a significant interest in something similar or along the lines of investment banking. Companies are going to be investing a lot of time, energy, and resources into you, and they want to make educated investments in their people.

If you’re looking to break into investment banking, try to put yourself in the best situation possible by getting a degree in accounting, finance, business, or economics.

Why Become an Investment Banking Analyst?

Raking in the Money

The starting salary for an Investment Banking Analyst is around $70,000 a year and can go up to as high as $150,000+ including bonuses. The downside is that if you divide the number of hours you worked, by your total income, the average income equates to $25 to $35 an hour, sometimes even less.

The upside is that there are often company perks, such as allowances for transportation and meals, especially if you are working after hours or on weekends. On top of that, if you do your job well, there are bonuses that can add up to be more than your salary. These have the potential to boost your earnings to around $150K or even $200K.

As you move up the ladder in investment banking, the pay starts to rise as well. In addition to performing less tedious tasks involving important financial decision making, and less of a time commitment.

Rising Up the Corporate Ladder

In banking, the corporate ladder can go incredibly high to some of the most powerful positions in the world. The people at the top of the largest banks often come out of banking. The prestige that surrounds banking is because of the time commitment, the dedication you have to have to your career, and the high percentage of people who get weeded out by it.

If you can persevere through your time at the bottom of the totem pole, the top is filled with almost what you can imagine. Success in the finance world, prestige for your career, and a financially rewarding position. Getting there takes time, commitment, experience, and expertise. The people at the top have put their life, time, and energy into their careers, and if you want to get there, you’re going to have to follow in their footsteps.

Learn Essential, Valuable Skills

Banking teaches you a variety of different skills that are valuable to companies in almost every and any industry. Companies love hiring kids who come out of banking because of the culture and nature of the industry. It forces you to become independent, dependable, and able to juggle multiple high priority tasks at one time.

The experience you get in banking is one of a kind. The work you have to do on a day to day basis, the commitment you have to show to your company, and the skills you need to produce at a high level will turn you into a highly sought after candidate in the job market.

A lot of what you do in banking is going to be working in programs like Microsoft Excel, Microsoft Word, and Microsoft PowerPoint, which almost all businesses and companies use today. The precision that’s required of you in the formatting, detailing, and execution of the complex models, presentations, and memos are skills that almost any company would love to have, and is what investment banking forces you to develop.

Become Skilled with Numbers

Finance, especially investment banking is all based around numbers, money, and math. Almost every decision is based upon data or formulas that are a result of numerical equations. The industry is built on financial models, calculations, and metrics that help project a profit, increase in value, or an increase in revenue.

Through banking, you’ll be able to learn what is going on behind the numbers of a company or transaction. It teaches you how to analyze financials, evaluates whether a market is poised to grow or decline, and see how the macroeconomy affects different industries.

You’ll start to understand what makes a good company versus a bad one. What metrics determine if an operation is running smoothly, or what needs to be restructured. You’ll see how and why companies raise equity, and which the financial benefits of each structure.

All of these are built on numbers and specifically financials. Going into banking will open you up to a new world of numbers, complex calculations, and difficult to grasp math concepts that give you a great understanding of the way numbers work.

Are Your Talents and Skills a Good Match for Investment Banking?

Banking is not cut out for everyone. It’s a difficult, and demanding lifestyle that requires a lot of sacrifices, high expectations, and significant pressure. The environment is cut-throat, and it’s expected that you’re aware of that going in. It’s filled with tight deadlines, complex work, and important tasks that could have an effect on millions of dollars.

Some questions to ask yourself before going into Investment Banking:

- Are you prepared to dedicate your life to a company for at least two years of your Career? The hours are long, the work is hard, and you won’t have a lot of energy left over after work. You’ll be going to have to make sacrifices in your social life, personal life, and overall lifestyle.

- How are your communication skills? Banking is an industry filled with pressure and expectations. The best way to handle those is to mitigate them through communication. Being able to communicate what is going on, and not being afraid to speak up is difficult but critical.

- Can you go the distance? A lot of people have a tough time sacrificing 1-2 years of their life as an investment banking analyst in order to put themselves in the best position possible for the long term. You’ll need to be able to handle the grueling pace, maintain a somewhat healthy lifestyle, and mental acuity. It isn’t enough to just to show up, you’ve got to handle the work and produce a high-level day in and day out.

- How are you with numbers and finance? Investment Banking is one of the backbones of the financial economy. It acts as a way for companies and institutions to come together in order to exchange assets, products, services, or goods in order to generate excess capital or returns. If you plan to apart of the process, it’s best to have an interest in, and be skilled with numbers and finance.

- Watch out for life in the fast lane. Banking is a fast-moving industry that gives you a significant income, prestige, and success. Life in the fast lane is difficult to maintain. It’s important to keep perspective about why you’re there and stay focused on your long term goals. There will be times where this will be difficult but are you up for the task of patience, humility, and discipline.

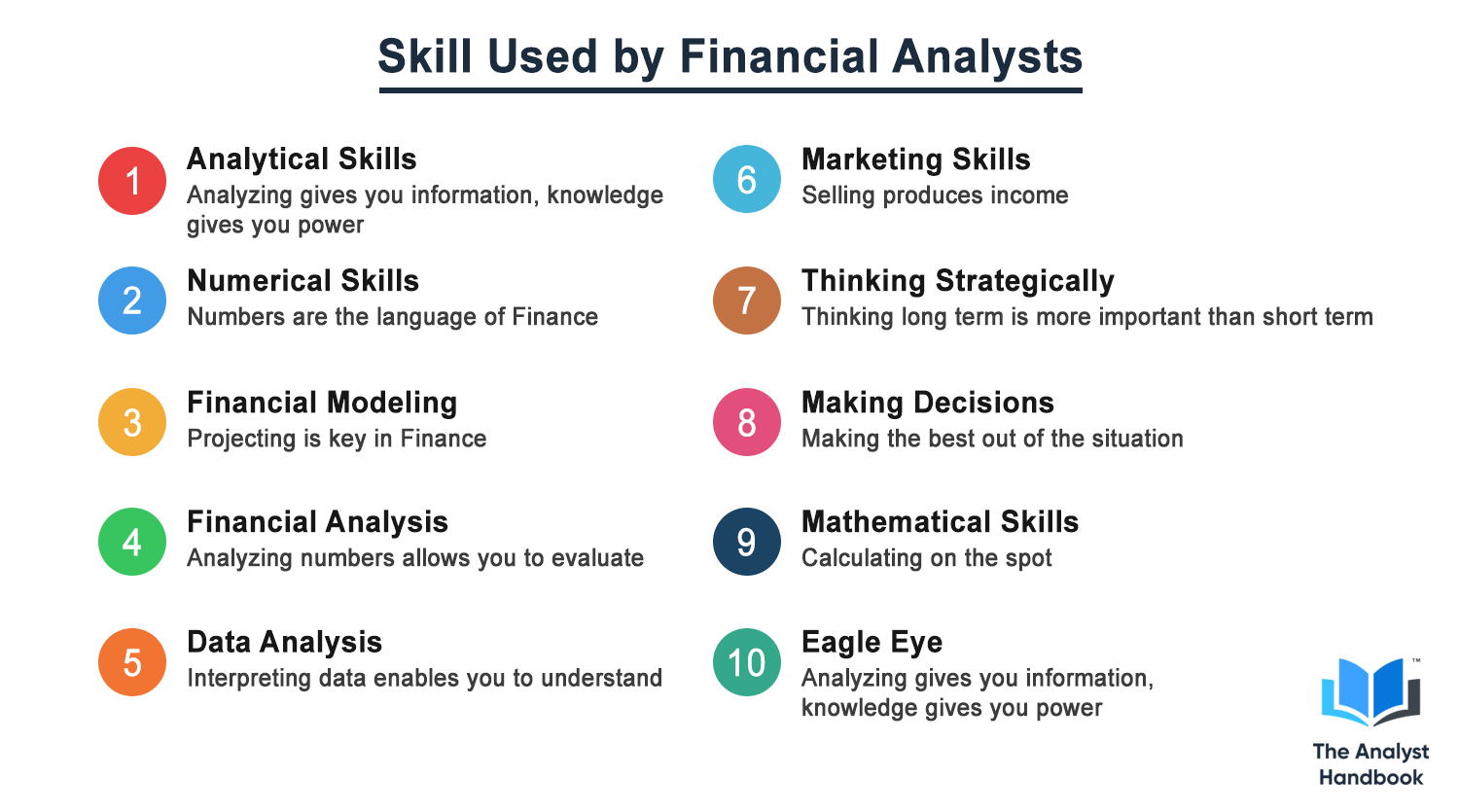

Skills Needed In Investment Banking

An Investment Banking Analyst is going to need a certain skill set, or at least a general understanding of certain skills in order to be successful. The tasks and responsibilities require the ability to be proficient in Microsoft Office, the ability to interpret financials and manage multiple assignments at once.

As an analyst, a lot of your time is going to be spent in Microsoft Office. Between Excel, Powerpoint, and Word, you’ll be spending about the majority of your time in those three programs. You’ll be putting together pitchbooks on Powerpoint, deal summaries/investment memos on Word, and financial models on Excel.

You’ll use these skills for:

There are going to be times when you need to take notes and you will need to be able to read them later. Practice these skills when attending lectures in your undergraduate classes so you have them sharply honed for the “real world.” From taking telephone messages to instructions from your boss, note-taking is a valuable skill in banking.

In a “buy-side” situation you will use your own research about markets to create your models. Other models might be “projections” or responses to client requests. It’s important to fully understand the equation of the task you’re executing. Financial markets are all interlinked and on a global scale, making it imperative you understand all the micro and macro relationships.

In both bookkeeping and accounting, there is a cautionary saying that runs, “It isn’t finished until the paperwork is done.” Make it a habit to record what you do and when you do it. It makes completing tasks and keeping a note of everything asked of you in an organized fashion. You never know when you’ll be asked if you did xyz, a few weeks or months ago. Its better to prepared than unprepared.

The Good Part…

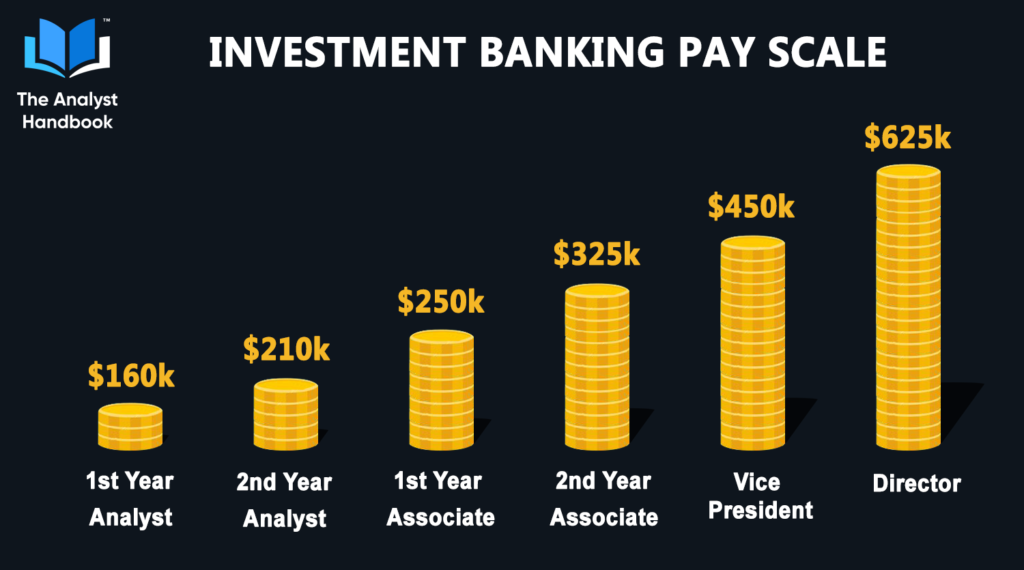

From our experience and knowledge, here is what you can generally expect for all in pay (salaries + bonuses):

Note: Keep in mind compensation depends on the company, bonus structure, deals you work on, and compensation structure. These are just generall ballparks.

- 1st Year Analyst

- ~$160k $70k-90k base, 50-100% of salary in bonus

- 2nd Year Analyst

- ~210k $90k-120k base, 50-100% of salary in bonus

- 1st Year Associate

- ~250k $120k-150k in base, 100%-150% of salary in bonus

- 2nd Year Associate

- ~$325k $160k-$220k in base, 100%-150% of salary in bonus

- Vice President

- ~$450k $250k-$350k in base salary, 100-150% in bonus

- Director

- ~650k $500k-750k in base, 100%-150% salary in bonus

- Managing Director, Senior Managing Director, Partner, CEO, Board Member, Chairman:

- Depends on Company, Deals, Position, Compensation Structure

Perks

Investment Banking definitely comes with ups and downs, but there are some great perks. Some of the bigger ones are the pay, prestige, and experience you get. But there are also other things to consider like the meals and transportation some investment banks offer. Depending on the company, most investment banks offer their employee meals if they stay past a certain time, generally around 7 o clock. Some also tend to offer transportation home to their employees if they stay past a certain time.

Bonuses

Part of the allure of investment banking is the way companies compensate their employees when it comes time for bonus season. The size of your bonus depends on the company and the way they structure their bonuses.

Depending on the deals you close or the projects you work on will often affect the size of your bonus check. The more money you help the company make, the larger your bonus check will be. Bonuses in banking can be up to 100% to 150% of your base salary, sometimes even bigger. One thing to keep in mind, is bonuses are paid to employees a few months after the year-end or fiscal year-end.

Conclusion

The Investment Banking Analyst position is where companies weed out the people who aren’t cut out for it. It’s a way for companies to see what each employee is made out of, a way for them to train their people, and help prepare them for what lies ahead.

Working in investment banking isn’t for everyone. The hours are long, the work isn’t always interesting, and it’s a constant grind. It’s one of the tougher industries to make it, but if you’re willing to put in the time, work, and effort, the upside and potential are unlimited.