What Can You Do With A Finance Degree

If you’re struggling with the question, of what to do with a finance degree, the good news is you have lots of options. A finance degree gives you a lot of opportunities and opens a lot of doors for you. There are tons of industries that are looking for people with finance backgrounds, and the degree is widely well respected. A lot of what finance is about is returns, money, calculations, formulas, and investment strategies that revolve around numbers. The good thing is, there are lots of companies, industries, and avenues that are looking for people to handle their numbers or are good with finances.

Depending on what you enjoy, what you like, and where you see opportunity are important factors of what you should do with your finance degree and the industry you should pursue. Each industry has different plusses and minuses, and there are benefits and disadvantages to each. We wanted to give you a quick rundown, or breakdown, of the different industries or opportunities available to you with a finance degree.

The Industry or Area You Choose to Pursue

Whatever industry, area, position, or type of position you decide to pursue, it’s important to have the right mindset, and the right motivation behind it. A lot of people try to finish school, and hit the ground running in the field they majored in or specialized in during their undergraduate career.

To put it in perspective, the field you decide to enter into is going to be where you spend the majority of your time for the rest of your life. You spend a lot of time working, and in the field you decide to pursue.

That’s why we wanted to write a few words about your mindset, or a few things to keep in mind when you’re deciding what industry, what area, and what position you want to pursue.

For a lot of people, this is the time in your life when you have the most flexibility, and the most opportunity to explore the different areas you’re interested in. You have the chance to mess up, fail, learn, explore, and educate yourself on a wide variety of different things that interest you. It might not come on the first try, it might not come on the second try, but your career is going to be something that you should enjoy doing for a long, long period of time.

Careers are built over the course of tens of years, and often require lots of sacrifices, lots of hard work, and lots of determination. The career you choose to pursue is going to be an important aspect of your life. That’s why it’s so important that you truly love or truly enjoy what you decide to do, and can see yourself doing something like it, or something similar to it for the rest of your life. As the incredible Steve Jobs once said, “The only way to do great work is to love what you do.” We completely agree with him and believe him to be on the money.

Finding something you’re good at, that you enjoy, and makes you the type of money you want to earn is a tough combination to find. It’s tough to find it all at once, and all in your first position as well. There’s a lot of merit to the saying that the best things in life take time. So, even if you have a job that isn’t what you’re looking for, or in an industry you don’t truly enjoy, you can always keep looking and find it, because eventually, it’ll come.

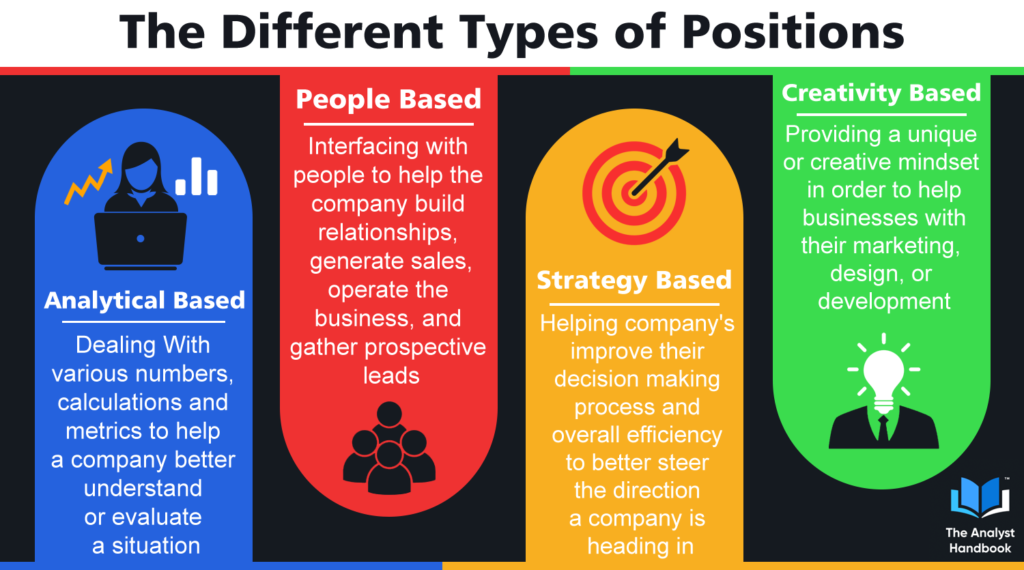

The Different Types of Positions

Analytical Based Positions

You can decide to go into or explore an industry that’s solely based around analyzing various numbers, and metrics. This means looking at different trends, different patterns, and trying to figure where a market is headed, or the reasons behind the numbers. A lot of this is involved with the stock market and trying to understand the news or the future direction of a particular market or company. Analyzing the different trends, and the different patterns behind the charts of certain companies, or the movements attached to certain trends, or within the reports is very common in a stock market or finance type of job. There are a lot of different positions out there that fall into this category like bond trading, stock trading, research, and many many others.

People Based Positions

Industries that are based on relationships and people are great for people who are outgoing and social. There are lots of industries or positions around this premise, but most center around sales. Whether it’s selling real estate, selling products, or selling software, sales-based jobs forces you to try and connect with people in an industry, and try to make a sale. A lot of sales-based jobs are focused around building relationships with people and trying to connect business or a company’s product/service to it. Lots of great salespeople, earn lots of money because of the commission-based structure that’s attached to sales. Depending on the type of person you are, the things you’re good at, and the things you enjoy, if they fall into one of these cateogires, or you find yourself thinking this might be a good fit for you, a people based position might be one worth pursuing.

Strategy Based Positions

Fields that are based around strategy, are often heavily involved with the direction of a company, or the way a business plans to operate in the future. A lot of times, it deals with the company’s operations, the way the company is run, or with the company’s progression into the future. Industries like consulting, often deal a lot with strategy, as their trying to weigh the different options available and decide which to choose from. They often have a lot to do with trying to restructure or to structure an investment or decision. Companies usually like to find people who are skilled or knowledgeable in a field, to help direct them in the most efficient, or the most effective way possible. If you like learning new businesses, learning new markets, and dealing with a variety of different people, a strategy based job might be one worth exploring.

Creativity Based Positions

Another direction you can decide to go in with a finance degree is into a creativity-based field. Creativity based fields force you to be creative and come to the table with a unique mindset. Some fields require a unique mindset or place a heavy emphasis on being creative. Marketing is an industry that tries to connect businesses to their customers, whether it be consumers or other businesses through a creative. To develop an effective marketing campaign requires a high level of creativity. A lot of what you’re doing is to try and find different ways to connect or relate to your prospective customers or audience. Through various positioning, various mediums, and various market channels, companies try to reach or relate to their prospective customers through the messaging or the marketing of their product. Marketing professionals try to match their product or service to the needs of the potential customer. Every marketing campaign deals in some capacity with the financial metrics behind it, or the financial results of it. If you’re looking to go into a creative based position, but still want to be within business, a creativity-based position might be worth pursuing.

The Overlap

Another thing we’d like to point out is depending on the types of positions, and the level of the position, whether its entry-level, management level or senior-level management, the type of work you do tends to evolve and change as you move up the ladder.

It’s pretty common to be more client-facing and more people based as you move up the ranks in most companies. The more senior you get, the more experience you have, the more you’ll be trusted and asked to participate in higher-level meetings. Whether that’s board meetings, c level exec meetings, or client-facing meetings. The responsibilities and positions change in a lot of industries as you rise up the ranks.

Another important thing we’d like to mention is each job usually has a combination of assignments that deals with the different types of positions we listed. There is usually one driving or predominant factor behind a position. What we mean by that is, most of the time you’ll do some analytical work, or people work, and or creative work depending on the position you have and the industry you’re in. Most positions will have some overlap, and you’ll find yourself doing the occasional task that requires more client-facing, or more creativity, or more strategy. There are lots of different positions, and industries available to you to pursue.

A Few of the Different Industries Available To You

Investment Banking

Going into investment banking is the highest level of finance there is. The hours are difficult, the work is demanding, but the salaries and the bonuses are the highest of any industry. The industry itself is the toughest and most well respected for good reason. The deals and transactions often go into the hundreds of millions, and sometimes into the billions when two companies merge or agree to acquire each other. The industry places a high emphasis on financial knowledge, and the drive to become a high-level financial professional. Its often a breeding ground, or a training place to pursue many other areas of finance like hedge funds, private equity, and institutional funds. Pursuing investment banking, will open lots of doors for you, and make you an attractive commodity on the job market. Just remember, it comes with a steep price to pay, but for some, is worth the time and energy. Here is an article that breaks down investment banking more in-depth, and the entry-level position of the investment banking analyst.

Real Estate

The Real Estate industry has developed into one of the more attractive and pursued industries with a finance degree. Companies on both sides of the table, buyer and seller have become attractive to undergraduate candidates, as it teaches you the different ways to analyze and understand a real estate transaction. Real Estate has proven to be a very lucrative asset class. The industry is primarily divided into two, commercial and residential. Commercial deals with the big pieces of real estate that institutional or business owners acquire, while residential is all about single-family homes or houses. The entry-level positions within Real Estate are generally created to help the senior-level people achieve their objectives. This might mean collecting data, putting together memos or financial models, or doing research on prospective clients or deals. A lot of the beginning positions in Real Estate are administered through the Real Estate Analyst position.

Corporate Finance

Another option available to you with a finance degree is corporate finance. Corporate finance primarily deals with the finances or the financial part of large corporations or companies. Usually, you’ll find yourself working within their finance division or department. A lot of the work done in these areas is trying to find more ways to make the company more profitable., analyzing various business lines, or understanding the financial end of a certain product or service. This might mean how to maintain current production or operations while cutting expenses. It might mean trying to forecast or predict how a certain product or service will do. It could also mean trying to understand or predict any changes in the marketplace they operate in, whether that’s through any major or macro-level events, any changes int he industry, or the different effects going on in the marketplace. Ultimately, you’re trying to help a large company become more financially savvy or in a better position financially.

Wealth Management

Another opportunity available to you with a finance degree is wealth management. Wealth Management deals with the managing of wealth, and the finances of ordinary individuals. A lot of wealth management has to do with managing the assets of people or clients trying to figure out different ways to achieve their financial goals. This means figuring out the different portfolio allocations and weights to give certain assets or asset classes depending on their appetite for risk. It might mean keeping a pulse on the financial markets and understanding the different directions they’re going in. Portfolios that are created well, and aligned with the client’s objectives often have good diversification and exposure to lots of different asset classes. This way, you’re able to have a strong and stable portfolio, that isn’t dependent upon one asset or asset class. People give you the keys to their financial car, and it’s important for their well-being that you are incredibly skilled and insightful about the investments you make on their behalf. You are acting as the one responsible for their financial well-being, and the well-being of their family. It’s incredibly important to take the position seriously and understand that people are entrusting you with their financial well being.

Consulting

As a finance major, going into consulting is a natural progression. Consulting deals with lots of different businesses, learning and understanding their financial metrics, and trying to figure out better ways to structure their financial situations. Having a finance background as a consultant can be incredibly helpful when you’re trying to figure out or decide which decisions or investments a company should make. Whether that means new inventory, a new investment, or a new cost-cutting investment. As a consultant, you’ll find yourself working with numbers and trying to figure out ways to make a business more profitable, more efficient, or more effective. The basis of consulting is to provide insight or information about the direction a company should go, the way a company should operate, and the best way a business should be run. The business itself involves lots of different clients, different types of businesses, traveling to various places and constantly learning about a new industry, a new business, or a new market.

Marketing

If you decide to pivot, and go a different route than most finance majors, marketing is something that’s available to you. With a finance background, you’d bring a unique mindset and skillset to a marketing team or a marketing company. A lot of what marketing is about is creating something interesting, or something that captivates the attention of the audience, then driving them to take your desired result. Whether that’s a sale, a lead, or a touchpoint. A lot of what drives marketing are the metrics and statistics behind each campaign. Most are financially driven or using various numbers or metrics to measure the success of a campaign. It’s much more of a creative area of expertise than most of the finance, which is lots of formulas and calculations. In marketing, you have the opportunity to be more expressive, more communicative, and more interactive with the audience you’re trying to connect with. There is still an element of finance within marketing, it’s just one aspect of the business.

General Finance

A lot of companies and businesses need finance people. Whether its for organizing or helping manage their finances, or even helping collect finances, there are lots of different types of finance positions that we haven’t touched upon. Every business has a financial component to it, and there are lots of positions that deal with finance, that we might not have a financial title, or fall into one of the categories we’ve mentioned. That’s why we wanted to create a category for various finance industry positions or various positions that involve finance. If you’re looking for more information on general finance, or the entry-level position in finance, check out our article on what does a financial analyst do?

Conclusion

A finance degree is a great resource and foundation to have. A lot of what you’ll learn is applicable both to your personal and professional life. What you choose to do with a finance degree is ultimately up to you, and is whatever works best for you. Everyone is different, and what’s good for one person, is not good for another. Figuring out what to do with a finance degree depends on the type of person you are, what you’re motivated by, and what you’re trying to achieve.

There are lots of types of positions available that are centered around analytics, people, strategy or creativity. Depending on what you enjoy, and the type of person you are, are two good places to start to figure out what might be the best route for you to take.

The industries and opportunities available to you are truly endless. A lot of finance degrees choose to pursue something like investment banking, corporate finance, real estate, or general finance. Certain industries have more of one type of position than others. There will definitely be an opportunity for you to learn and explore regardless of what type of industry or position you get. Some tasks and assignments will vary on the types of task you do, and be different than the ones you’re used to, or different than what the position is centralized upon.

Any industry you decide to pursue is something that you should truly enjoy, be intrigued by, and interested in. If you’re going to be working at something for a long time, it’s going to be a hard challenge to keep going, yet if you don’t truly enjoy it, it’s going to be that much harder.

The attitude and mindset you have behind a position will say a lot about the types of results you’ll be able to achieve. If you’re motivated and determined to persevere, you’ll find a way through. If you’re discouraged and annoyed, you’ll find a way to leave.

We hope that you’ve learned and gained some value from this post. Whatever industry you choose, and wherever position you decide to pursue, we hope you have all the success, recognition, and fulfillment you desire.